GRAZE: Demand alters landscape for Domestic Grassfed Beef

– – – –

Recent developments in the U.S. grassfed beef sector will have a major and lasting impact on the industry and alter the way business is conducted.

Over the past several weeks, two of the “Big 4” beef packers in the U.S. launched efforts to initiate domestic grassfed beef programs. Also, a major fast food company has launched a line of “All Natural Grass Fed Beef” hamburgers at selected locations.

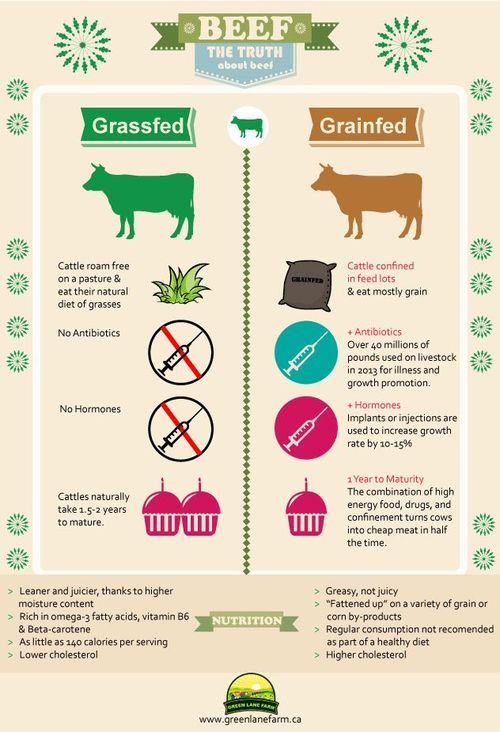

Carl’s Jr., a chain with 1,150 restaurants, announced that it will offer an “All Natural Burger” featuring an “all-natural, grass-fed, free-range beef patty” with no added hormones or antibiotics. The burger was scheduled to be available at participating Carl’s Jr. locations starting December 17, 2014.

A “single” burger will cost $4.69, with a “double” selling at $6.99. Customers can substitute the grassfed patty for any burger on the menu for an additional charge. Carl’s Jr. claims it will be the first “major fast food chain” or quick service restaurant (QSR) to offer an all-natural, grassfed beef hamburger. Some in the media are calling this the first “clean” burger in fast food.

The grassfed beef is imported from Australia. Carl’s Jr. has stated in the media that this is because of a lack of available domestic supply. Price point is a major factor for a QSR like Carl’s Jr., so most likely there is not enough domestic supply available within an appropriate price range to satisfy the restaurant chain.

Meanwhile, National Beef and JBS, two of the Big 4 packers, have established grassfed beef divisions in their respective companies and hope to launch grassfed offerings in 2015. Both programs will seek grass-finished cattle that meet or exceed both USDA Grass Fed Standards and the American Grassfed Association (AGA) production protocol.

They desire grass-finished cattle that grade USDA High Select and USDA Choice, and will likely develop a formula-based payment program that rewards grassfed beef finishers for the better-grading cattle and those that achieve higher dressed-weight yields. The cattle would be harvested at select plants within each company’s system, so animals finished within a reasonable proximity to these plants would be favored. Both companies hope to begin with several loads (each 40 head) of cattle harvested weekly, and ramp up to more than 1,000 head per week.

Cargill, another member of the Big 4, has been active in the grassfed beef sector for several years. The company owns one of the largest beef packers in Australia, and from there has been harvesting grassfed beef and exporting it to the U.S. and other countries. With National and JBS establishing domestic grassfed beef programs, Cargill may elect to follow suit. That leaves Tyson, the final member of the Big 4, watching and waiting.

What does all of this mean for the grassfed beef sector in the U.S., and how will it affect existing grassfed beef producers and marketers?

First, the introduction of programs by members of the Big 4 and a major fast food chain immediately legitimizes grassfed beef as a true “player” in the protein sector. Those in the conventional industry who poked fun at grassfed beef or deemed it a fad can no longer do so.

As happened years ago with All Natural Grain Fed beef, entry by the major packers immediately makes grassfed a viable alternative for the consumer. Awareness of grassfed beef among the broader consumer population will skyrocket. Demand for domestically produced grassfed cattle will ramp up significantly.

If consumers respond favorably to the grassfed beef burgers offered at Carl’s Jr., we can expect to see expansion into Hardee’s, which is owned by the same company. Other chains will also feel compelled to follow with their own offerings. For several years, McDonald’s, Arby’s, Burger King, Subway and Quiznos have looked at grassfed beef options, but have yet to pull the trigger. The launch by Carl’s Jr. will surely stir the pot within those companies, and talks will be renewed.

All of this will ratchet up demand for grass-finished cattle, and therefore the need for significantly greater grass-finishing capacity. Since National and JBS have indicated they will be seeking cattle that grade USDA High Select and Choice, we will see expanded demand for cattle that are a genetic fit for grass-based production. These will need to be cattle that finish well at well below 30 months of age on a forage-based diet that fits the USDA and AGA grassfed standards.

To accomplish this will require highly skilled forage finishers who can finish cattle to a high degree on a year-round basis and within a 20- to 24-month age range at harvest. To avoid cattle “aging out” at the processing plants, JBS and National will seek cattle that are source and age-verified.

These developments are sure to cause gnashing of teeth for some in the grassfed beef business. Others will see potential opportunity. As news of these developments spreads further among the grassfed community, it will be interesting to see and read the many varied reactions.

They will range from “the sky is falling” to “this will grow the entire grassfed beef sector.“ While it should not be the case, some will be completely surprised by the Big 4 entering the grassfed beef market. With annual growth rates between 25-30% over the past 15 years, and with grassfed now accounting for 3-6% of the total beef market share in major metro markets, entry by bigger players was inevitable. Long-established branded meat programs (Strauss Brands, Meyer Natural, Maverick Ranch, Nolan Ryan All Natural, Allen Brothers) had entered the grassfed market, so it was obvious that the Big 4 were eventually coming. What may surprise many is that it happened so quickly.

It is quite evident that the development of the grassfed beef sector has closely mirrored that of the All Natural Grain Fed Beef sector. In the early days of that movement, we saw pioneers and entrepreneurs take the initial risks, challenges and slings and arrows. They were derided and accused of being enemies of the beef industry. They were told that what they were doing was simply a fad that would quickly die.

Instead, these pioneers slowly but surely built a strong and loyal customer base, gradually altering the landscape of the industry. As they gained market share, larger programs began to buy and consolidate the early efforts. Then the big packers joined the fray and started their own All Natural programs. Today, almost every major beef program has their own All Natural beef label. However, several of the original programs found ways to survive and thrive through all the challenges presented over the past three decades. The pioneers in the grassfed beef sector will have to do the same.

These changes will not be a major challenge to direct marketers. If you have established a solid business, you will not see any major changes in demand. Your customers will remain loyal and will continue to buy from you. They are looking to buy direct from the farmer or rancher, and are not likely to switch to a more anonymous Big 4 supplier.

The challenges for existing grassfed branded programs are much more real. The Big 4 have far more resources and capital to throw at the sector, and distributors and retailers are commonly more loyal to price points than to particular branded programs.

Make no mistake, the entry of JBS and National into the grassfed beef sector will create heartburn for many of the existing branded programs, and they will have to examine how best to compete in the marketplace. JBS and National will increase the competition for an already record-low pool of feeder cattle.

On the other end, they will create competition in wholesale pricing with their greater economies of scale and cheaper processing. Existing grassfed branded programs need to examine the older, well-established branded beef programs, and learn from them how to be successful in an ever-competitive market.

What will all of this do for grassfed cattle pricing? We could see some initial bidding wars due to a sharp increase in demand at a time of short feeder cattle supplies. But the packers push a sharp pencil and will not overpay for long, especially in light of the current historic price highs. The packers’ formula-based systems will offer higher prices for quality, while discounting poorly finished cattle.

This is a great opportunity for producers to establish themselves as providers of grassfed beef. There will be many more programs searching for providers, and getting yourself known in that circle will be important. There will also be opportunity for people to come on line as professional forage finishers, although they will need to be capable of finishing at least several hundred head annually, and do so most of the year.

While there may be some attempt to establish forage feedlots, these will be a minority. The grassfed beef sector has done a great job of educating the consumer to expect pasture finishing. The AGA will be watching closely, and will speak out rather loudly if the big packers attempt to make this a feedlot production system.

So sit back, take a deep breath, and don’t get overly excited one way or the other. As a smart businessperson, pay close attention to what your competitors are doing, and learn from them. Determine how you can best differentiate your program to the consumer and/or how you can work with other programs to grow market share as a whole. Always remember — where there are challenges, there are opportunities.

by: Allen R. Williams, Ph.D.